Your participation in the two surveys below, aimed to gather your insights and perspectives on accessibility and accommodations at colleges and universities, is greatly valued and appreciated.

Welcome students, parents, teachers and support professionals. We’re excited to have you here!

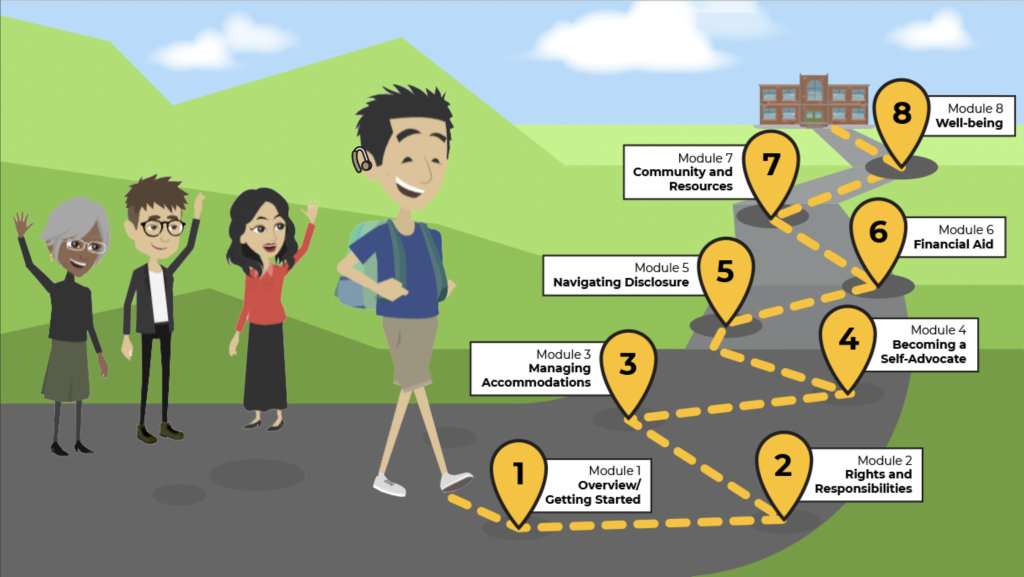

Welcome to Transition into Post-Secondary Studies (TIPS). If you’re a high school student, it means you’re probably considering making one of the biggest decisions of your life: to attend college or university! You may also be an adult student who is making your way through your post-secondary studies. For either situation, this course was designed to guide you through the planning required and to provide you with the information, knowledge, and skills that will help you confidently manage your journey in post-secondary education, campus life, your practicum experiences, and beyond.

Developed by ACE-BC’s team, this online course is as an extension of workshops that were created in collaboration with the Canadian Hard of Hearing Association – BC Chapter’s Youth Peer Support Program, an audiology consultant, The Provincial Deaf and Hard of Hearing Services, The Deaf, Hard of Hearing, Deaf-Blind Well-Being Program, along with additional support from Assistive Technology-BC (ATBC) and the Inclusive Campus’ DREAM project which supports students in their classroom and practicum experiences.

We hope this course helps you begin with developing your action plan as you prepare to start or continue your post-secondary education. In addition to this online learning, we also invite you to register for our Student Mentorship Program. This will be an additional source of support as you work on navigating the world of post-secondary education.

This course is designed to support students who are Deaf, hard of hearing or Deaf-Blind/deafblind, and with additional disabilities, and we also recognize that the transition process for all students with disabilities is a significant leap. In fact, many of the fundamental preparations, and skills regarding disclosure and self-advocacy for example, apply to any student who will be planning for accommodations and equitable access for their post-secondary experience. This course was designed to help make the leap easier, by offering preparation support for students and their support networks.

At the same time, we also believe in the shared responsibility for access and inclusion that lies within the post-secondary system. ACE-BC also provides support and resources to the post-secondary institutions, to help improve accessibility in all facets of the learning environments.

If you have any questions or feedback about this course, you can reach us at: office@ace-bc. Please be sure to complete the pre and post-surveys. Your feedback will help us ensure that our content is as valuable and relevant as possible for you.

We look forward to supporting your success in your educational journey!